“Risk comes from not knowing what you are doing.”

Warren Buffet

“Don’t tell me the Odds”

Han Solo in Star Wars

Risk management – Perspectives and approaches

„Nothing ventured – nothing gained” is an old saying. Businesses take on risks; otherwise the expected returns would seldom be higher than the ones of sovereign bonds. Hence, risk management cannot be about eliminating all risks or even minimizing risks across-the-board. Instead, objectives need to be to (1) create the transparency to enable management to make decisions under uncertainty and to (2) create a balance between opportunities, risks, risk bearing capacity and to (3) ensure that risks in the operative business don’t get out of control.

Our approach on risk management focuses – as strategy consultants – on the support of decision making by top management. Models and quantitative methods can help, but for us they are mainly a means and not an end. We use them to enable a structured approach and an alignment of management. First, assumptions are made explicit, secondly the implications of decisions and market developments can be analysed in a comparable way for different options and scenarios

In practice, oftentimes small and known risks are quantified extensively with a technology-focused use of models and methods (e.g. FX- or commodity price volatility). Standard approaches experience more difficulties with the often more important large and potentially jeopardizing risks such as structural market changes, creeping decline of competitive advantage etc. We help clients to see the trees and the wood. We work fact based and with structured and quantitative approaches. But we always follow a very pragmatic management-oriented approach: Many important assumptions and scenarios are based on management beliefs and assessments. We help to challenge and further develop these and to integrate them in the decision making process in a structured way.

Topics for support

We use a broad portfolio of tools and methods for supporting clients in a wide range of topics, e.g.

- Strategic Portfolio-Management

- Risk-return based assessment of investment decision making and definition of capital cost

- Enterprise Risk Management (ERM)

- Dynamic financial planning

- Hedging and commodity trading

- Risk measurement and reporting

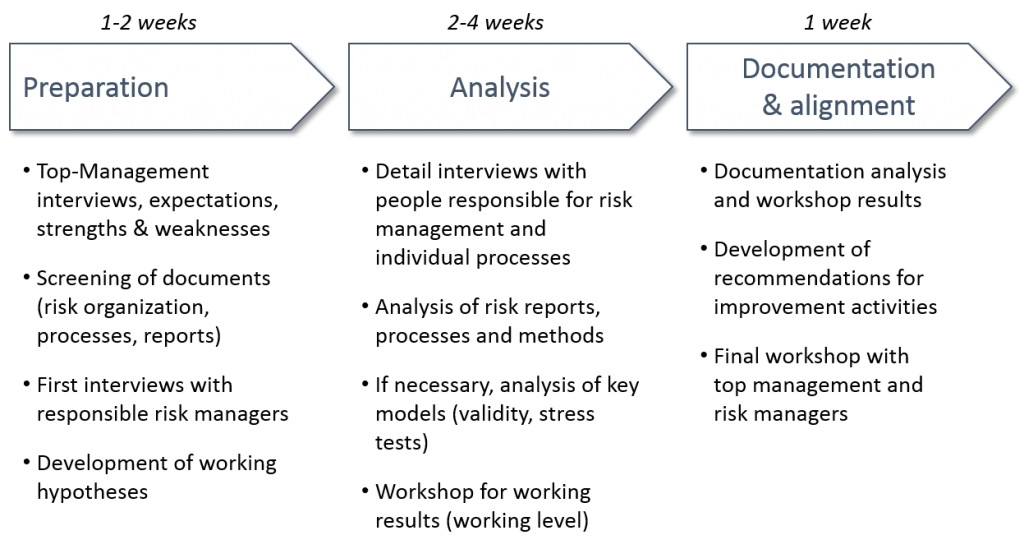

Example Project Approach – ERM health check